Mine Is Mined

Why NOT Lab Grown Diamonds

The market over the last 5 years has been swept by lab grown diamonds. They have been sold as ethical products, excellent for the environment and cheaper than their natural equivalent while looking the same. While this has numerous truths to it, there is a flip side. The emissions through production are quite high, they are cheaper than their natural equivalent but not in the correct proportion but what really needs to be taken into consideration is their true value.

The Trend is Your Friend

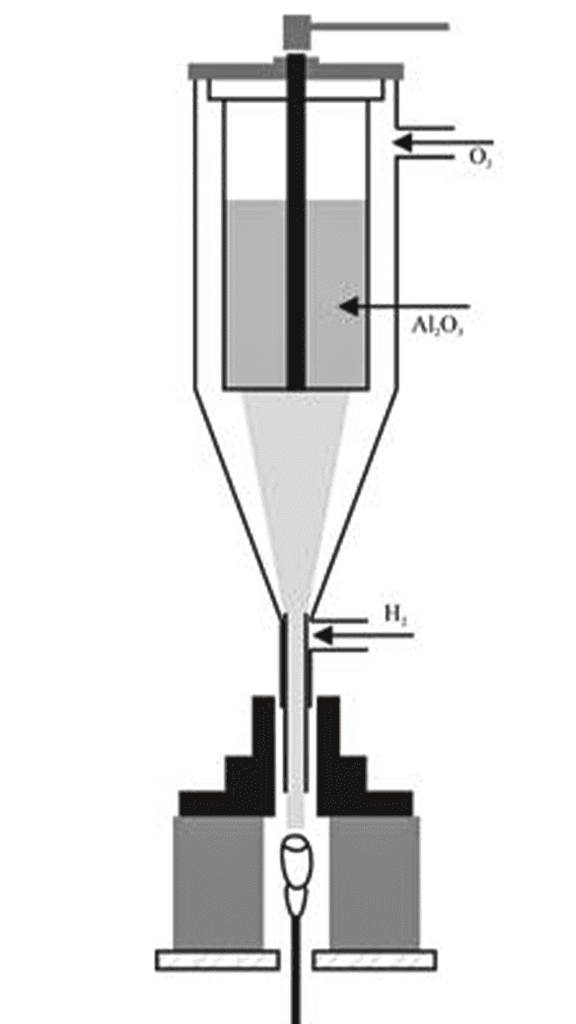

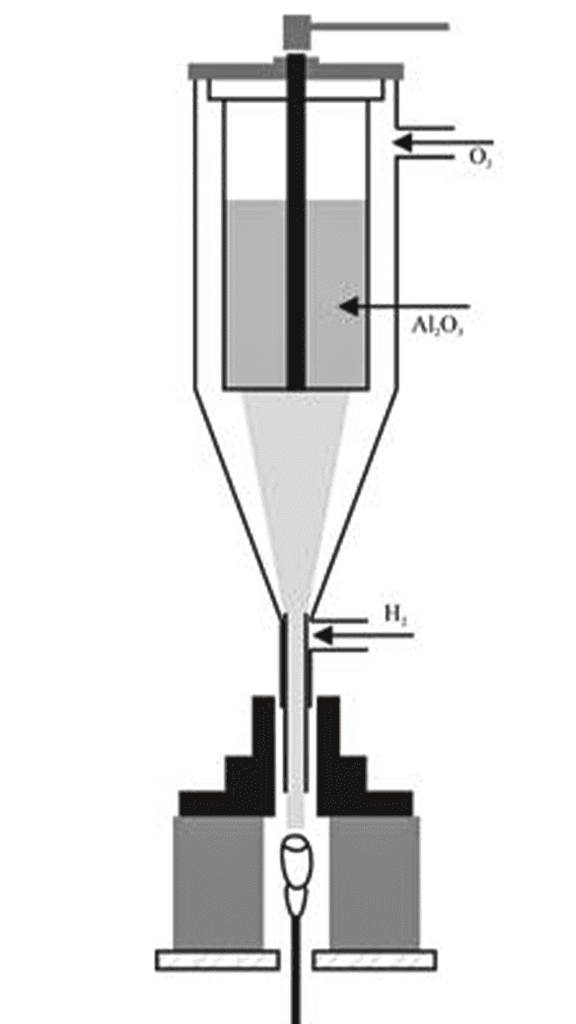

In 1901, Francis Verneuil invented the Verneuil method for lab grown diamonds. An upside-down oxygen hydrogen flame is used, aluminium oxide is fed through the flame at 2050 degrees Celsius (method and ingredients for rubies) and we end up with a pointed cylindrical boule really large in size; 100’s of carats in a few hours.

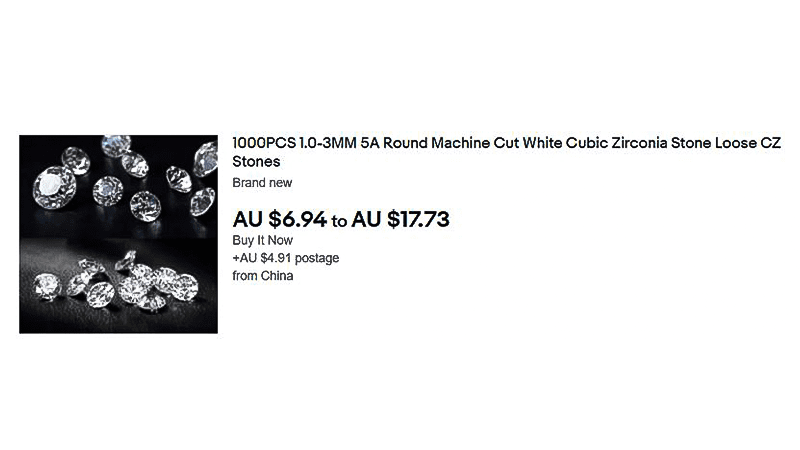

Various methods of identifications exist and generally the best is viewing through a microscope to observe the structure. The most common gemstones to be produced through this method are rubies and sapphires. While this discovery has been excellent for industrial purposes, it somewhat introduced us to our first taste of market trends. It was a new technology and many people wanted synthetic sapphires and rubies in their jewellery. Art Deco jewellery was known for it. In fact, if you ever come across an Art Deco piece with natural sapphires, you should be concerned it may be a reproduction. Over the years as technology improved and identification became simple, prices plummeted. Similarly decades later we witnessed the synthesising of Moissanite (rarely found in nature) in addition to emerald (commonly utilising the Hydrothermal method) and most famously cubic zirconia. The two things all these gemstones have in common is their prices started high and over time plummeted. Technology improved, identification simplified, demand waned and everyone returned to nature. Below is the latest listing for cubic zirconias being sold in China.

In 1901, Francis Verneuil invented the Verneuil method for lab grown diamonds. An upside-down oxygen hydrogen flame is used, aluminium oxide is fed through the flame at 2050 degrees Celsius (method and ingredients for rubies) and we end up with a pointed cylindrical boule really large in size; 100’s of carats in a few hours.

Various methods of identifications exist and generally the best is viewing through a microscope to observe the structure. The most common gemstones to be produced through this method are rubies and sapphires. While this discovery has been excellent for industrial purposes, it somewhat introduced us to our first taste of market trends. It was a new technology and many people wanted synthetic sapphires and rubies in their jewellery. Art Deco jewellery was known for it. In fact, if you ever come across an Art Deco piece with natural sapphires, you should be concerned it may be a reproduction. Over the years as technology improved and identification became simple, prices plummeted. Similarly decades later we witnessed the synthesising of Moissanite (rarely found in nature) in addition to emerald (commonly utilising the Hydrothermal method) and most famously cubic zirconia. The two things all these gemstones have in common is their prices started high and over time plummeted. Technology improved, identification simplified, demand waned and everyone returned to nature. Below is the latest listing for cubic zirconias being sold in China.

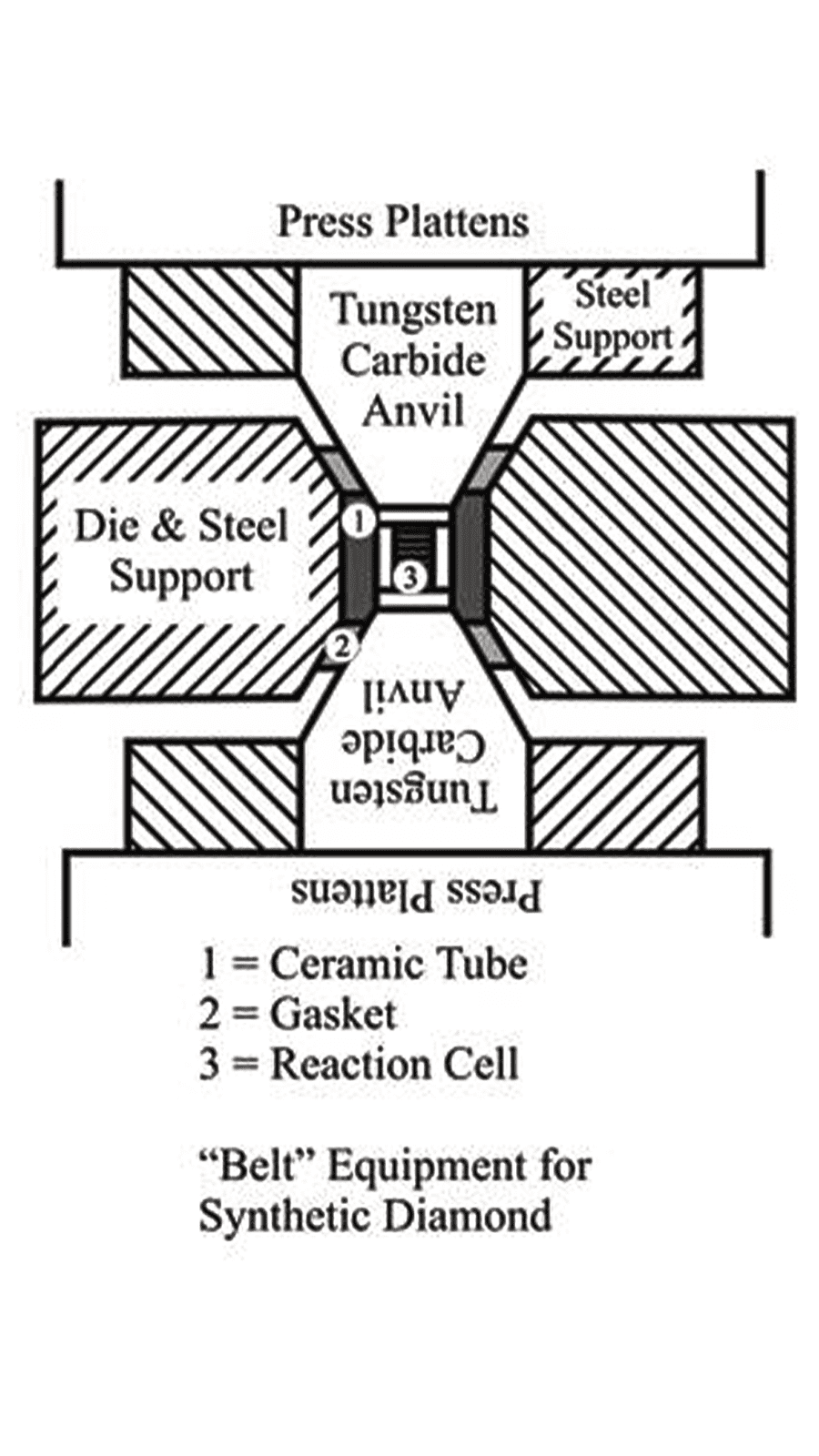

We now continue to Lab Grown Diamonds. For industry purposes, they are an excellent invention. Thinking about the numerous technologies and equipment that can benefit from the bulk production of these materials; grinding wheels as an example. In jewellery though this is not the case. As the trend has been over the last century for synthesised materials, the price has always been downward. Technology improves, production increases and costs are cut. Whether you are producing a 1ct or 5ct diamond, the cost is virtually the same per ct, if not less as you go up. The COSCO bulk buying effect. Natural diamonds on the flipside quadruple on average for every carat you increase. Why, rarity and demand. Tell someone tomorrow that you need a 5.0ct diamond pronto and they don’t have it in stock. These people will need to search the globe high and low to find it. The same does not exist for lab grown diamonds as they are produced on demand.

As with the synthetic materials discussed above, lab grown diamond prices are on the way down. The one advantage they carry is identifying them is difficult. Even the best gemmologists worldwide are being fooled because the technologies to identify them are one step behind. Large sums of money are being thrown on producing technologies that can easily identify them, such as the diamond tester that was produced to differentiate a diamond from a cubic zirconia. These pieces of equipment as we speak are significantly improving and the prices are becoming more affordable for the average gemmologist to have within their grasp. This will save large amounts of time doing multiple tests in order to come up with a somewhat conclusive answer as to whether the stone is natural or synthetic. When you combine cheap production, improved technologies, easy identification, the current price decrease and then look at the trends of the past, it is very clear where this is heading.

What This Means

If you invested in shares that were guaranteed to go down, will you do it? It is the reality that should be facing everyone looking to invest in a lab grown diamond. The last time I valued one according to the general retail market, the price was approximately half that of a natural. This is because retailers and manufacturers are creating a false market for such a product. As mentioned above, for every carat you increase in a natural diamond, on average the price increases by 4 fold and yet we seem to observe lab grown diamonds are present selling for around half that of natural. What is the rarity factor in this? I will finish off by saying in 1997 DVD players were selling for over $1,000, by the end of 2002, 80 million DVD players were sold, the average price was $100 and at the time it was the fastest adopted consumer device ever. Synthetic gemstones, modern day technologies and the already decreased price of lab grown diamonds, are you sure you want to go down that path?

George Ojaimi

Founder and Director of Ojamie and Jewellery Valuers Melbourne

Lecturer at the Gemmological Association of Australia

F.G.A.A Gemmologist

NCJV Registered Valuer V0355

Specialist in ‘Synthetic and Imitation’ gemstones

B.Bus (Mktg)