The Miracle of the Diamond

Khalil Gibran once stated, ‘Perhaps time’s definition of coal is the diamond’. A beautiful quote and somehow partially true. Diamonds are time travellers, part of slightly larger formations that travelled through the sea, get taken deep into the ground and come back to the earth’s surface. A process telling the story of the nature’s miracle of recycling. In 1979 when the Argyle diamond mine was first discovered, the motions for a second nature miracle were put in place: the ‘vivid pink diamonds’ it would produce. Their value was not astronomical though and only varied slightly compared to their white counterpart.

What We Know: The 4C's

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Pricing Influence in a Diamond

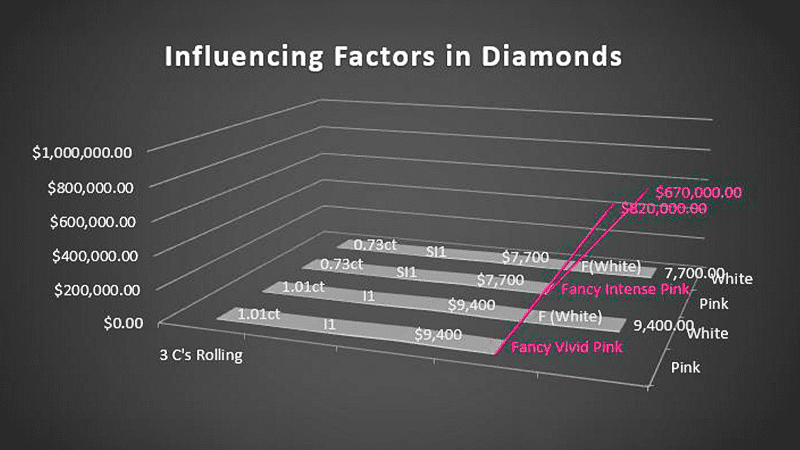

Over the years, we became accustomed to diamonds being white and what strongly influenced their price was clarity, cut, weight (carat) and colour, typically referred to as the 4 C’s. Previously, the more colour a diamond would reveal, the lower it was priced, and this is commonly the case today when diamonds are too brown or a tinted yellow but the opposite reigns supreme when it comes to other colours, namely here, pink. Once a diamond shows a hint of pink, prices become astronomical. We saw this begin in the 80’s, grow in the 90’s and explode through the 2000’s, arguably becoming the Bitcoin of stones. But why are we seeing this happen? Several reasons and among the major is rarity coupled with beauty. The Argyle mine produced 8 million carats of diamonds annually, ONLY 5% is gem quality and to further narrow down, only 1% of that gem quality material is pink. That amounts to approximately 4000cts (800 grams) per year distributed over a world of demand. Comparing to white diamonds at 400,000cts.

The Present of Argyle Pink Diamonds

The demand for pink diamonds grew and the price mimicked the growth increasing almost exponentially over the years. George Ojaimi was signing off on updates for insurance valuations that had increased up to 40-fold in the last 30 years. This demand was driven by investors, collectors, gem enthusiasts, diamond lovers and those who knew that a place like it had never been discovered. Over the years we came across South African and Russian material but it would not compare to the intensity and depth of colour the Argyle soil would provide. Argyle (owned currently by Rio Tinto) began certifying individual pink diamonds as small as 0.08ct in December 2016. The tenders were attracting sheikhs, princes, well off political figures and investors worldwide; all chasing after the lucrative find from Argyle. The graph below illustrates just two of the Argyle pink diamonds I came across in the last 5 years and the only influencing price factor was colour. The 3 other C’s were seemingly thrown out the window and suddenly an opaque pink stone was astronomically priced and demanded compared to a flawless D coloured white.

Why Are Pink Diamonds Astronomically Priced?

High Demand and Very Low Availability

Numerous rare gemstones exist. Among them is the famed alexandrite; tanzanites located only in Tanzania, silky Kashmir sapphires which mine has been closed to commercial production for many years. Yet, the prices don’t come even close to that of pink diamonds. Several factors exist. Number 1, the diamond industry is highly regulated. Rio Tinto has an incredible hold. Almost all diamond mines worldwide are government or private entity controlled directly or indirectly part of the Kimberly Process. This has led to strict controls on the diamond industry. Coloured gemstones are not at the mercy of these regulations and are freely traded. Hobbyists and professional miners looking for the coloured gemstone find have created their own dangerous makeshift tunnels. When you have a similar system, consistent pricing can be difficult to impose. Therefore, you add to a regulated industry an extraordinarily rare find, Pink Diamonds, the result is an astronomical increase. Will it hold? Only time will tell.

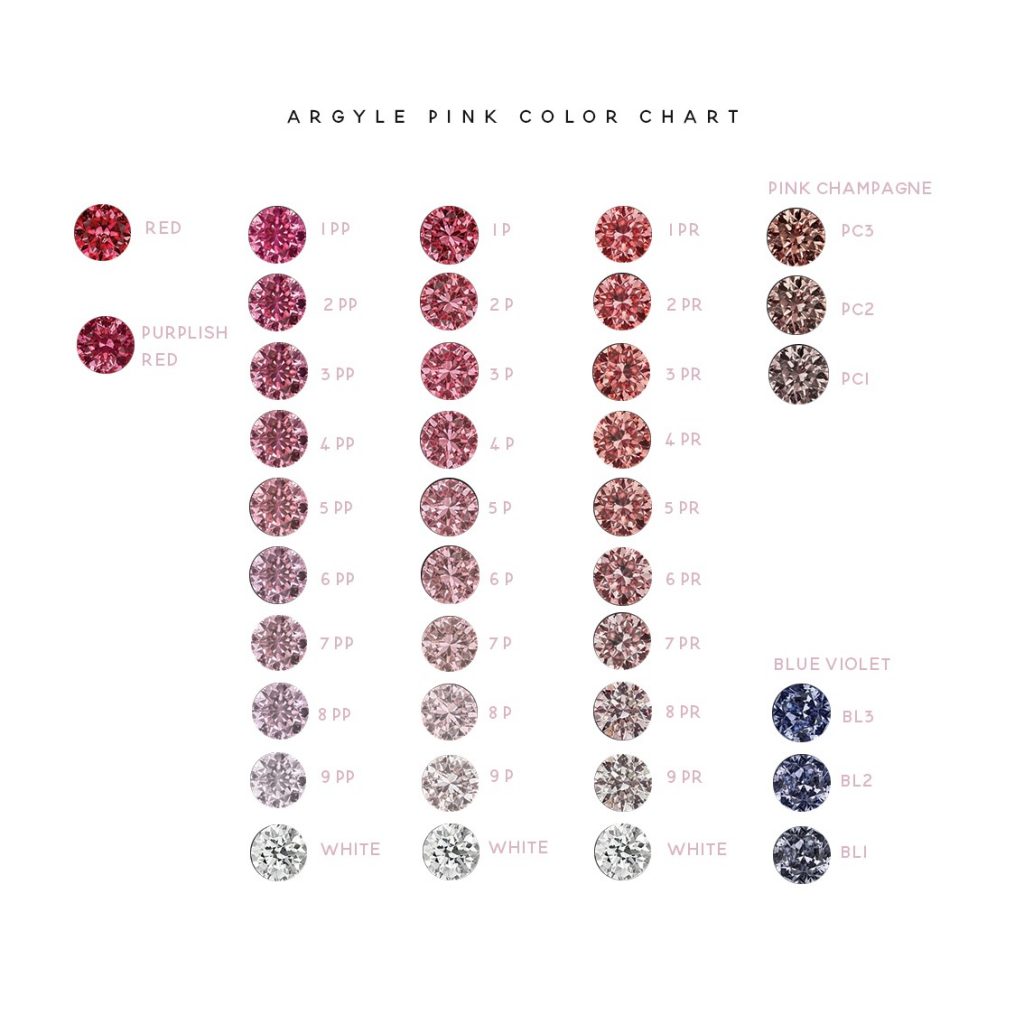

The Colour Grading System

A colour grading system was invented solely for pink diamonds mined in Argyle. Other mines worldwide go by the GIA colour grading system and this is why often you will see an Argyle diamond also come with an equivalent GIA certificate. The system creates fine separations between pink grades, associates them with Argyle and these grades are each linked with a price per carat. The closer you reach to the top left red, the rarer and more demanded it becomes, the result a higher price per ct.

The purpose behind your pink diamond purchase will strongly influence which grade you choose. Those looking for an investment and those looking to have them set in jewellery are recommended to target different charts and this can only be determined during a consultation process.

George Ojaimi, Founder of Ojamie and Jewellery Valuers Melbourne specializes in the identification, grading and procurement of these pinks. He has access to tender stones assisting those who are looking to invest or simply desire pink diamonds for jewellery. This is a service offered only to those who are serious about acquiring pink diamonds. It is strictly by appointment only. For interest, please contact Ojamie to schedule a no obligation 30-minute appointment where we will need to gain an understanding of your precise requirements.

Ask For More Details

Ojamie Diamond Experts can assist you in choosing an engagement ring,

personalizing a wedding band or selecting a special anniversary gift